Your Vision.

Our Expertise.

Custom Window Treatments, Designed for Your Space.

Get expert advice, custom measurements, and a personalized quote—all at no cost.

Why HunterDouglas?

Premium Quality. Personalized Service.

Discover the difference with our custom window treatments, tailored to fit your style and needs. Our expert consultants will guide you through every step, ensuring a perfect fit for your home.

How It Works

From Consultation to Installation—We’ve Got You Covered

-1: Book Your Free Consultation

-2: Get Personalized Recommendations

-3: In-Home Measurement & Custom Quote

-4: Enjoy Professional Installation

Ready to see what’s possible?

Explore Our Premium Collection

Tailored Solutions for Every Room in Your Home

Smart Shades. Smart Living.

PowerView® Automation: The Ultimate in Comfort and Control

Imagine shades that move on your schedule, enhancing your comfort, privacy, and security with the push of a button. PowerView® Automation puts you in control, from adjusting your home’s lighting to boosting energy efficiency. With real-time communication and zero cords, you get smarter, safer living—all day, every day.

Shades That Fit Your Style, Perfectly

Custom Designs, Endless Possibilities

Whether you’re after the modern elegance of AURA™ Illuminated Shades, the soft touch of Sheer Shades, or the classic appeal of Roman Shades, we’ve got everything handled. Our wide range of customizable options ensures your shades will be the perfect fit for your home—designed to match your style and meet your exact needs.

Blinds Built for Beauty and Performance

Tailored to Your Style, Built for Your Life

Whether you prefer the classic elegance of Parkland® Wood, the durability of Modern Precious Metals® Mini Blinds, or the soft versatility of Luminette® Sheer Panels, we have the perfect solution. Our blinds are fully customizable, allowing you to choose the exact finish, style, and functionality to match your home’s needs.

Drapery Designed for Luxury and Function

Tailored to Your Vision, Perfect for Your Home

Discover the beauty of Carole Fabrics, the elegance of Luminette® Sheer Panels, and the organic charm of Provenance® Woven Wood Shades. Our drapery solutions offer endless customization, so you can choose the perfect fabric, style, and finish to match your unique taste and create a space that truly feels like home.

Shutters That Define Elegance

Custom-Made for Your Unique Space

From the timeless beauty of HERITANCE® Wood Shutters to the durable elegance of PALM BEACH™ Polysatin™ Vinyl, our shutters are designed to elevate any room. With a range of materials, finishes, and styles, we customize each shutter to perfectly match your home’s aesthetic and functionality needs.

Watch how we bring your vision to life with a free in-home consultation.

Your Dream Home Is Just a Click Away!

Book Your Free Consultation Now and Save Up to $1,200 with the Federal Tax Credit!

Experience the Difference with Alexa

Personalized Design, Seamless Experience, and Up to $1,200 in Tax Savings!

Alexa brings a wealth of design knowledge and a passion for helping clients make the most of their homes—and their budgets. By booking a consultation, you’ll not only get personalized design solutions but also learn how to take advantage of the federal tax credit and save up to $1,200. Let Alexa guide you through the process, ensuring your project is both beautiful and cost-effective.

Frequently Asked Question

Can I really save up to $1,200 with the federal tax credit on Hunter Douglas shades?

Yes, you can save up to $1,200 on your taxes by purchasing and installing eligible Hunter Douglas Duette® Honeycomb Shades. The federal tax credit allows you to claim 30% of the purchase price as a credit, but this doesn’t include measuring or installation costs. Just make sure to purchase and install your shades between January 1 and December 31 of the applicable tax year, keep your invoice, and download the necessary certificate to bring to your tax professional.

What is the Federal Tax Credit for Energy-Efficient Home Improvement?

The Federal Tax Credit is designed to encourage homeowners to make energy-efficient upgrades. Thanks to the Inflation Reduction Act of 2022, you can earn this credit annually from January 1, 2023, through December 31, 2032. To qualify, you need to install eligible products in your primary residence (no vacation homes or rentals) by December 31 of the applicable tax year.

How Does the Federal Tax Credit Work?

This isn’t a rebate—it’s a tax credit. That means it’s not cash in your pocket but an amount you subtract directly from the taxes you owe. It’s a great way to reduce your tax bill when you invest in energy-efficient home improvements.

Which Hunter Douglas Products Qualify for the Federal Tax Credit?

Certain Hunter Douglas Duette® Honeycomb Shades qualify, but they must meet specific criteria—like being installed inside mount over double-pane, clear glass windows. To see if your shades qualify, check the Manufacturer’s Certification Statement and the Qualifying Product Document at www.hunterdouglas.com/tax-credit. Remember, these products need to be installed by December 31 of the qualifying tax year.

What is a Manufacturer’s Certification Statement?

It’s a signed document from Hunter Douglas confirming that the products you purchased qualify for the tax credit. This statement, along with the Qualifying Product Document, certifies the eligibility based on specific product details. You can download it from www.hunterdouglas.com/tax-credit.

How Much Can I Get from the Federal Tax Credit?

You can claim a tax credit equal to 30% of the purchase price of qualifying products, up to $1,200 per year. The purchase price includes the product and sales tax but excludes measuring and installation costs. If sales tax applies to both the product and labor, only the tax on the product counts toward the 30% credit.

What’s the Maximum Federal Tax Credit I Can Claim Each Year?

The maximum tax credit you can claim in any given year is $1,200, even if you purchase multiple qualifying products. For example, if you spend $5,000 on qualifying products, you’re eligible to receive 30% of that amount, up to the $1,200 cap. Consult your tax advisor to confirm your eligibility.

When Can I Earn the Federal Tax Credit on Qualifying Hunter Douglas Products?

The credit is available annually from January 1, 2023, through December 31, 2032. You can claim the credit each year for qualifying purchases made and installed in that year. However, if you buy a product in one year and install it in another, you’ll claim the credit in the year it’s installed. The qualification depends on the Qualifying Product Document in effect during the year of purchase. Consult your tax advisor for more details.

What Do I Need to Submit for the Federal Tax Credit?

Keep your itemized Hunter Douglas invoice, proof of payment, the Manufacturer’s Certification Statement, and the relevant pages from the Qualifying Product Document. To claim the tax credit, you’ll need to complete IRS Form 5695 (or any updated version) and submit it with your tax return. Always check with your tax advisor to ensure you’re using the correct forms.

Current Certification Resources

Purchases After Jan. 1, 2024

Get In Touch

Email: [email protected]

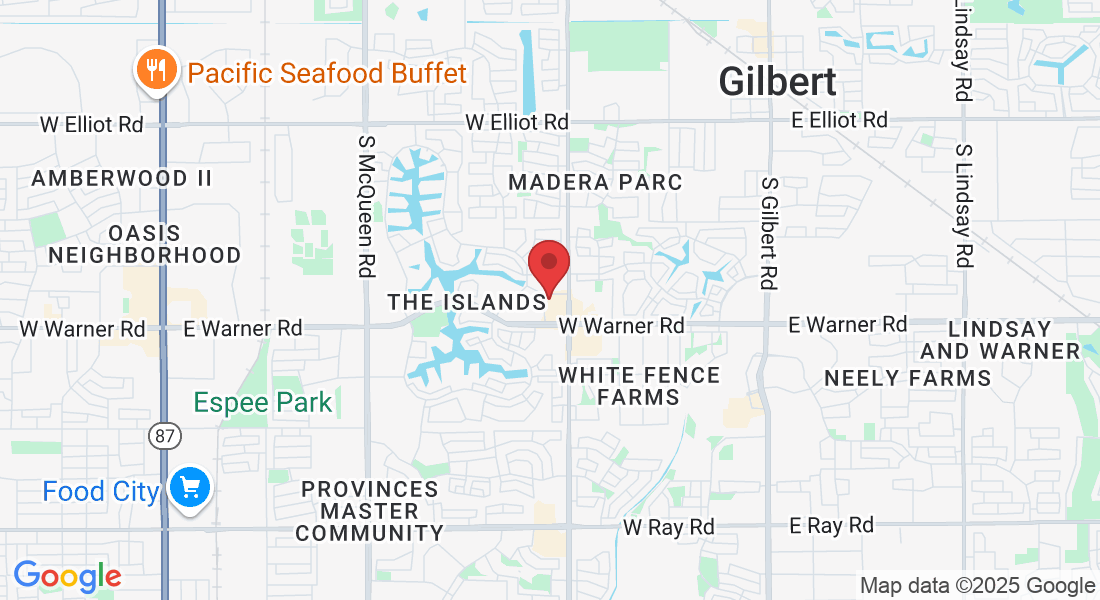

Address

Office: 694 S. Cooper Rd Ste A3 Gilbert, AZ 85233

Assistance Hours

Mon – Sat 9:00am – 4:30pm

Sunday – CLOSED

Call Us:

Text Keyword:

"GET QUOTE": 1-888-995-4877